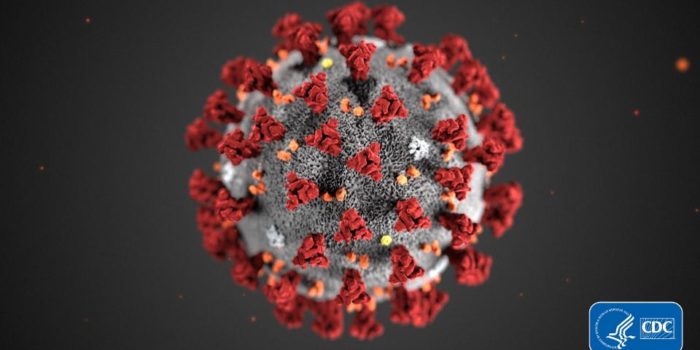

The Coronavirus continues to rattle investment markets as the number of new cases outside China continues to rise posing increasing uncertainty over the impact on economic activity.

Story: Michael Yardney – propertyupdate.com.au

Clearly 2020 isn’t going to be the year many of us expected it to be.

Drought, bushfires, and now the corona virus

So what’s ahead for our property markets in light of the corona virus issues?

Are they going to crash like the stock market has?

Is Australia going to fall into recession?

These are questions on the mind of many investors in light of the economic woes around the world and the uncertainty surrounding the coronavirus.

So watch as I discuss these important questions with Dr. Andrew Wilson, Australia’s leading housing economist and chief economist for MyHousingMarket.com.au.

Now we’re not downplaying the potential medical issues related to the coronavirus.

Clearly many Australians will come in contact with the virus over the next couple of months, some people will suffer cold and flu like symptoms while other more frail members of the community will succumb to the germ.

And that is tragic.

At the same time many businesses will suffer, particularly those in hospitality, tourism, education and those who supply chain from South East Asia will be affected.

But the biggest effect will be the slashing of business and consumer confidence.

Not only do we now have a pandemic – we have an “infodemic” with the media, including social media scaring us and panicking many people into buying toilet paper, bottled water (why? the virus doesn’t live in water) and even avoiding Chinese restaurants in suburban Australia. (????)

Back to my original question, what will this due to our property markets?

It seems there are two extreme views on coronavirus.

- Some see it as just a bad flu and can’t see what the fuss is all about.

- Others think that it will trigger a major humanitarian and economic catastrophe killing millions and triggering a major global recession as excessive leverage is finally exposed.

Watch as we give our views on what will happen to our property markets.

Of course, we don’t really know what the outcome will be, how well the governments stimulus packages will work, or how severe the epidermic will spread.

But based on our perspective, both having been involved in property for over 40 years; while this issue will have an effect on our economy and a short-term impact on our property markets, because consumers will become less confident and sit on the sidelines waiting for things to become clear, I believe in a year from now, and in particular five years from now. and most certainly in 10 years from now, this pandemic will have had no influence on where Australian property market will end up and the value of your and my home at that time.

Don’t get me wrong – I see some serious short-term economic issues, but the underlying fundamentals supporting Australian property markets have not changed.

As I’ve always said…don’t make 30 year investment decisions based on the last 30 minutes of news.

It is quite likely that Australia’s economy will fall into a technical recession in the first half of this calendar year.

But given a likely recovery in the second half of this year, it is much more likely that this will be a short-term, but major disruption to our economic growth rather than the type of recession Australia last experienced early 1990s.

Of course, the outcomes for our economy, jobs growth and our unemployment figures will depend upon the effectiveness of the stimulation package and government is proposing.

So from a property perspective, a virus that will affect our economy for 6 weeks or 6 months will come and go in a relatively short time frame.

What about the share market correction?

The share markets have always been volatile.

Over the last 40 years, here’s what took place:

- There have been 12 corrections of 10% or more Australian stock market

- There have also been corrections of 20% or more to Australian stock market

- We have suffered 5 recessions with 2 quarters of negative growth in the past 40 years

The current significant drop in the Australian (around 17% drop) in the Australian stock market has taken us back to January 2019 levels – not much better than it’s high just before the GFC in 2008

Yet in those last 10-12 years the value of well-located properties around Australia doubled.

Remember…

Like all the other worldwide epidemics we’ve experienced in the past, this too shall pass.

It is likely that the coronavirus scare will last months, but your investment in prime residential real estate will give you payback for a lifetime.

Any short-term dip in consumer sentiment should be seen as a buying opportunity for those who have a secure job, good streams of income and finance pre-approved.

At his inaugural address in 1930 Franklin D Roosevelt said: “There is nothing to fear but fear itself.” These are wise words.