Vacancy rates in Sydney’s inner and outer ring suburbs are increasing due to a mix of low demand and high supply, according to the Real Estate Institute of NSW.

Story: Sean Slatter – therealestateconversation.com.au

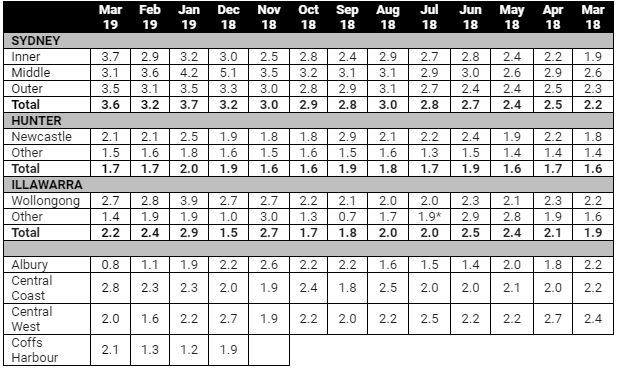

The March REINSW Residential Vacancy Rate Report reveals an increase of 40 basis points in vacancies across Sydney, which went from 3.2 per cent on February 15 to 3.6 per cent on March 15.

Based on the proportion of unlet residential dwellings to the total rent roll of REINSW member agents on the 15th of each month, the report collects the total properties on agency rent rolls, the number of properties that were vacant on the 15th of the month, and the postcode in which a majority of agents’ rental properties are located.

At a glance:

- The March REINSW Residential Vacancy Rate Report has revealed an increase of 40 basis points in vacancies across Sydney, from 3.2 per cent on 15 February, to 3.6 per cent on 15 March.

- The Illawarra region saw a 20 basis point fall in the vacancy rate to 2.2 per cent.

- The Hunter region remained steady at 1.7 per cent.

REINSW President Leanne Pilkington said the feedback from agencies suggested landlords had played a part in the differing fortunes of some Sydney suburbs.

“The vacancy rate in Sydney’s Inner ring – areas such as Ashfield, Leichhardt and Marrickville – increased in March due to lower demand and high supply,” she said.

“Sydney’s outer ring is also experiencing a similar situation.

“Feedback from real estate agencies in areas such as Baulkham Hills and Blacktown has been that old, dated units are harder to lease for the same price they had been getting previously, and landlords are unwilling to drop rental prices.”

Ms Pilkington told WILLIAMS MEDIA she expected the trend to continue in the short term, adding that agents needed to educate landlords with current examples of the properties that are renting and at what price.

“First home buyers are making up almost a quarter of loan approvals, so many of them are taking the opportunity of lower prices to buy property, coupled with some off the plan properties completing, we don’t see any changes in the short term.

“What will impact this market is a change in policy from a government perspective.

“Landlords that are focused on keeping yields at a certain percentage overall may be less likely to drop prices than those that have different investment criteria, and are more focused on making mortgage repayments.”

Residential Vacancy Rate Percentage. Source: REINSW

Of the other regions in NSW, vacancy rates in the Hunter region remained steady, particularly in Newcastle where there was a 2.1 per cent vacancy rate in both February and March. Other areas in the region dropped by 10 basis points from February to 1.5 per cent this month.

In the Illawarra region, Wollongong and surrounding areas saw 20 basis points fall in rental vacancies, from 2.4 per cent on 15 February, to 2.2 per cent on 15 March.

According to the report, the rest of the state saw increased in six key areas: the Central Coast (to 2.8 per cent), Central West (to 2.0 per cent), Coffs Harbour (to 2.1 per cent), Mid-North Coast (to 2.8 per cent), Orana (to 1.8 per cent), and South Eastern (to 2.9 per cent).

Albury (0.8 per cent vacancy rate), Murrumbidgee (0.9 per cent), New England (2.2 per cent), and the South Coast regions (2.6 per cent) saw decreases this month of between 30 and 50 basis points.

The report for March is based on survey responses covering 113,100 residential rental properties.